I’ve maintained that the decline in the Ringgit is largely a function of the decline in global oil prices. Here’s some proof (or to be more precise, corroborating evidence):

The above charts show daily price movements of a barrel of Brent crude (in USD terms) and the USD/MYR exchange rate (in MYR terms) since 2012. The graphs are fairly similar, with a positive correlation of 60.5% between the two series.

Correlation is of course not the same as causation. You can’t say from the above that one causes the other. So I ran through a couple of different models to prove causality exists in the statistical sense. If you don’t want to go through all the technical stuff, you can jump to the conclusion.

First up is a couple of straightforward linear regression (in log form), which yields the following (standard errors in {}):

LOG(USDMYR) = 0.075{0.01}*LOG(USDXCB) - 1.51{0.05} + [AR(1)=0.99[0.00]] R2=0.987

LOG(USDXCB) = 0.70{0.11}*LOG(USDMYR) + 5.54{0.13} + [AR(1)=1.01{0.00}] R2=0.991

The AR terms were required handle serial correlation in the error terms. Unit root tests of the residuals (using ADF and KPSS tests) confirm stationarity, which means that there is a long run relationship between Brent prices and the USDMYR exchange rate. The direction of causality can’t be determined however, as both regressions are equally valid.

[Students might recognise this as the original Engle-Granger approach to testing for cointegration]

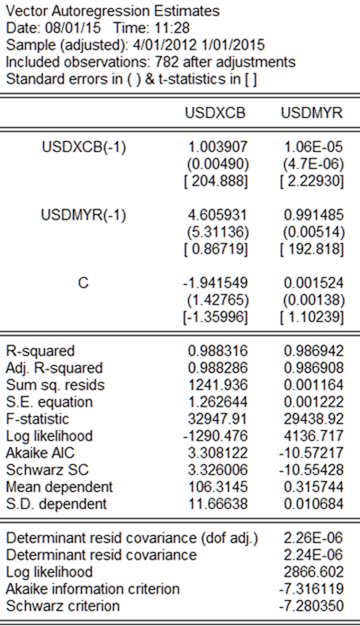

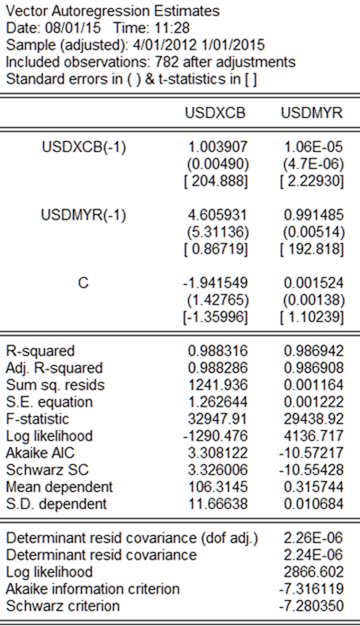

So on to the next –a VAR:

The lag length of one was chosen by examining lag length criterion methods like AIC and SIC, the majority of which suggested a lag of one (I tested up to lag 30). Log transformation of the variables yielded largely similar results, so I’m not bothering to report those. Even without fiddling with AR terms, the R2 is very high at 0.988.

Just examining the standard errors will tell you all you need to know – USDMYR doesn’t help determine Brent prices, but the opposite is not true. The standard error for the coefficient of the USDMYR(-1) term for the USDXCB vector is larger than the coefficient itself, i.e. the null hypothesis that the coefficient is not statistically different from zero cannot be rejected. The other coefficient estimates are all statistically significant.

More formally:

USDXCB Granger causes USDMYR, but USDMYR does not Granger cause USDXCB.

To put all this into laymen’s terms, I’ve proven statistically that Brent prices move first followed by the MYR exchange rate, and that there is a close relationship between the two.

Unfortunately, because of the lag length of one, you can’t test for cointegration via the Johansen procedure, otherwise it might be possible to determine the underlying structural form of the relationship via a vector error correction model. That could possibly be done with an ARDL Pesaran-Shin bounds testing procedure, but I don’t have the software for that.

One other thing gleaned from this whole exercise: the forecast estimates suggest the sell down in the Ringgit has been excessive – it’s now substantially lower than the long term relationship suggests. With Brent at USD50 per barrel, the implied USDMYR exchange rate should be about 0.295, or RM3.38 per USD, compared to yesterday’s exchange rate of RM3.57. That’s approximately a 5.4% difference.

As usual, the FX markets have overshot the fundamental value.

The above charts show daily price movements of a barrel of Brent crude (in USD terms) and the USD/MYR exchange rate (in MYR terms) since 2012. The graphs are fairly similar, with a positive correlation of 60.5% between the two series.

Correlation is of course not the same as causation. You can’t say from the above that one causes the other. So I ran through a couple of different models to prove causality exists in the statistical sense. If you don’t want to go through all the technical stuff, you can jump to the conclusion.

First up is a couple of straightforward linear regression (in log form), which yields the following (standard errors in {}):

LOG(USDMYR) = 0.075{0.01}*LOG(USDXCB) - 1.51{0.05} + [AR(1)=0.99[0.00]] R2=0.987

LOG(USDXCB) = 0.70{0.11}*LOG(USDMYR) + 5.54{0.13} + [AR(1)=1.01{0.00}] R2=0.991

The AR terms were required handle serial correlation in the error terms. Unit root tests of the residuals (using ADF and KPSS tests) confirm stationarity, which means that there is a long run relationship between Brent prices and the USDMYR exchange rate. The direction of causality can’t be determined however, as both regressions are equally valid.

[Students might recognise this as the original Engle-Granger approach to testing for cointegration]

So on to the next –a VAR:

The lag length of one was chosen by examining lag length criterion methods like AIC and SIC, the majority of which suggested a lag of one (I tested up to lag 30). Log transformation of the variables yielded largely similar results, so I’m not bothering to report those. Even without fiddling with AR terms, the R2 is very high at 0.988.

Just examining the standard errors will tell you all you need to know – USDMYR doesn’t help determine Brent prices, but the opposite is not true. The standard error for the coefficient of the USDMYR(-1) term for the USDXCB vector is larger than the coefficient itself, i.e. the null hypothesis that the coefficient is not statistically different from zero cannot be rejected. The other coefficient estimates are all statistically significant.

More formally:

USDXCB Granger causes USDMYR, but USDMYR does not Granger cause USDXCB.

To put all this into laymen’s terms, I’ve proven statistically that Brent prices move first followed by the MYR exchange rate, and that there is a close relationship between the two.

Unfortunately, because of the lag length of one, you can’t test for cointegration via the Johansen procedure, otherwise it might be possible to determine the underlying structural form of the relationship via a vector error correction model. That could possibly be done with an ARDL Pesaran-Shin bounds testing procedure, but I don’t have the software for that.

One other thing gleaned from this whole exercise: the forecast estimates suggest the sell down in the Ringgit has been excessive – it’s now substantially lower than the long term relationship suggests. With Brent at USD50 per barrel, the implied USDMYR exchange rate should be about 0.295, or RM3.38 per USD, compared to yesterday’s exchange rate of RM3.57. That’s approximately a 5.4% difference.

As usual, the FX markets have overshot the fundamental value.

Technical Notes:

- Exchange rate and Brent crude oil data from the Pacific Exchange Rate Service

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.